Schedule your custom demo

Ready to do all your accounting inside Salesforce?

Take control of your business

AEDON.ACCOUNTING

Drives efficiencies and reduces costs.

Schedule your custom demo

Ready to do all your accounting inside Salesforce?

Fast to implement

Right out of the box

Cheap to own

Easy to customise

Fast to implement

Right out of the box

Cheap to own

Easy to customise

Bottom-Up Reporting

Bottom-Up Reporting is a unique feature to Aedon.Accounting and allows accurate reporting at the lowest level to ensure control across the business.

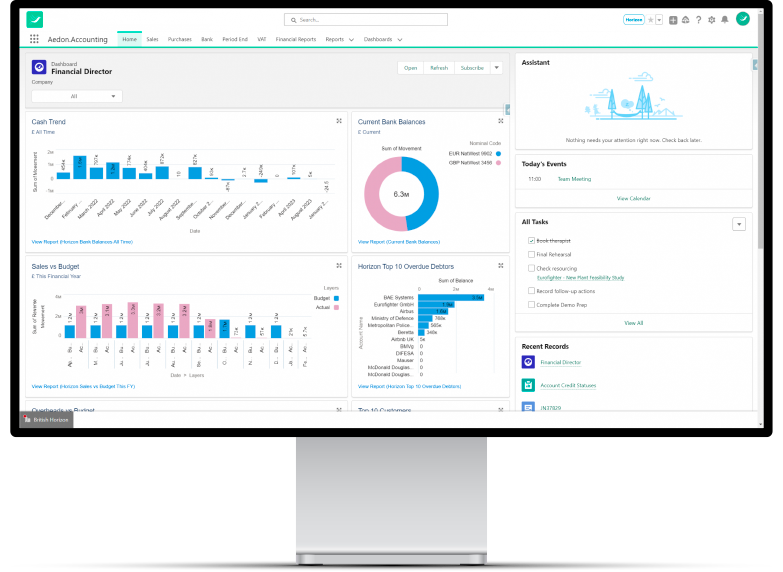

Aedon.Accounting Home Page

Aedon.Accounting showcases a customisable Home-Page allowing all roles to get the information they need, quickly.

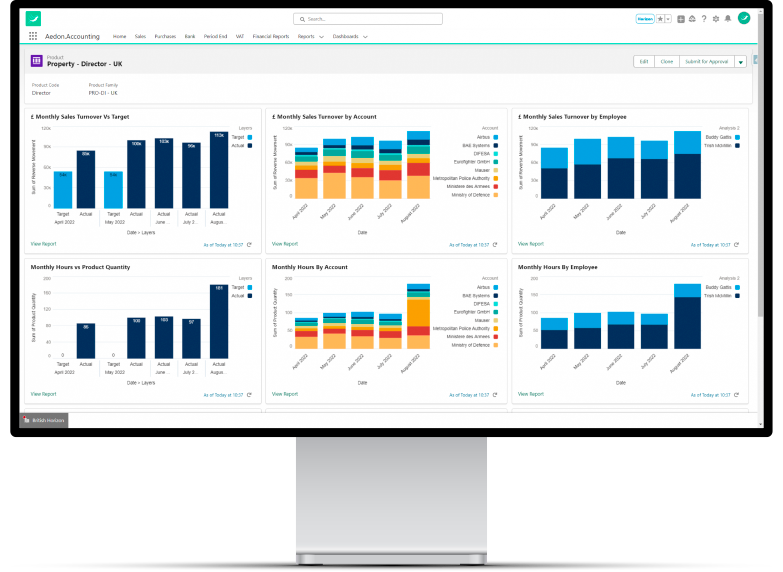

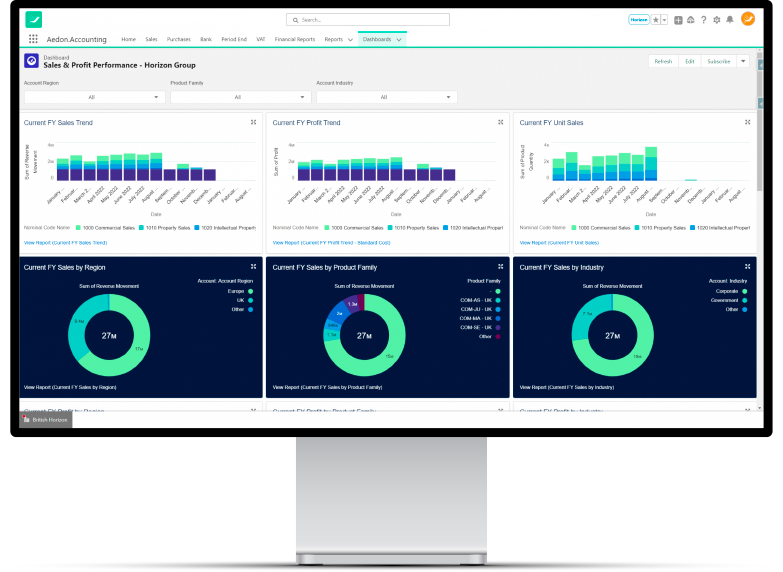

Brilliant Performance Dashboards

Aedon.Accounting uses the powerful reporting functionality of Salesforce to compile all your data in one place in an easy to digest format without the need for crafting complex spreadsheets.

Robust Reporting

Aedon.Accounting’s Financial Reports give you everything you need in one place enabling you to make decisions faster and clearer.

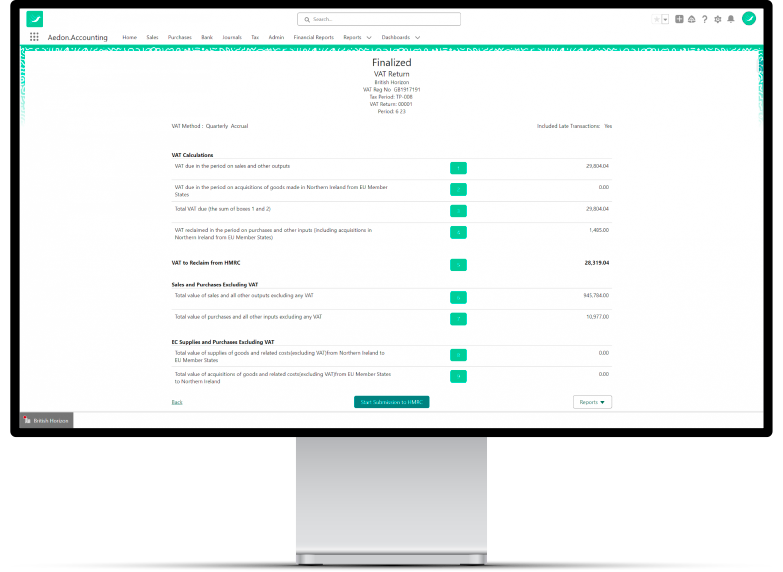

Easy VAT Submission

Aedon.Accounting is a HMRC Recognised software enabling you to submit VAT returns directly within the software.

Product Features

Product Features

Full Power of the Salesforce Platform

Aedon.Accounting is hosted on Salesforce allowing you to either connect your existing CRM directly with your accounting or upgrade to a true Cloud Finance Solution.

Multi-Company and Multi-Currency

Supports unlimited companies and currencies with cross company consolidation.

Revenue Recognition and Recurring Invoices

Aedon.Accounting offers easy-to-use wizards to guide you through complex processes.

Automated Bank Reconciliation

Bank transactions are fed five times per day to an automated bank reconciliation, including matching rules and payment of open invoices.

Complete Finance Package

Aedon.Accounting is a HMRC recognised accounting package, that you can get Free Forever reducing your costs and ensuring compliance.

Direct Debit & Payment Integration

Automated handling of direct debit payments and collections including failures.

Automated Processes & Approvals

Thanks to Salesforce’s powerful automation suite, we can empower your finance team by automating the mundane, daily, weekly, monthly tasks.

Native Reports & Dashboards

Reporting is Salesforce’s bread and butter, no more exporting your reports to Excel! View and create any report, chart, or graph within Aedon.Accounting.

Bottom-Up Reporting

This unique feature allows you to have a complete insight of your business at your fingertips, it allows precise reporting on Job Numbers, Products or any Analysis Code you want.

Who is Aedon.Accounting For?

Who is Aedon for?

Improve your finance department’s efficiency, accuracy, and reduce costs with Aedon.Accounting, the perfect solution for start-up businesses who have outgrown platforms like Xero, Sage and QuickBooks. The native connection of Aedon.Accounting to Salesforce also allows for increased automation and reduced duplication.

Are you reaching the limitations of the following starter accounting software packages?

Then it’s time to superpower your accounting platform.

Upgrade to Aedon.Accounting and unleash your businesses full potential!

A Typical Aedon.Accounting Implementation

Typical Implementation

There are four stages to Implementation; Design, Configuration, UAT and then optionally, Parallel Running.

A standard implementation plan and data migration template are available on our knowledgebase – Aedon.Assistance.

Before starting any implementation we recommend taking stock of any spreadsheets and processes that may have become unmanageable and draft new ideal process plans.

Having a plan in place allows you solve all your problems in your new accounting system.

We recommend a vanilla implementation for ease of adoption and implementation and once you’re happy then work on the improvements using the benefits of Aedon.Accounting and Salesforce.

What others are saying

Customer reviews

Aedon combines CRM and finance to drive down costs and increase revenues PLUS all the customisation that Salesforce enables. Learn more on our Salesforce AppExchange page.

These are all genuine customer experiences shared by users of Aedon.Accounting on our Salesforce AppExchange page. Click below to learn more.

Accounting Solution native to Salesforce

The team have worked tirelessly to understand what customers really need from a finance/accounting solution that works seamlessly on the Salesforce Platform. Aedon is built on Salesforce and so leverages all the awesome core functionality offered by the worlds #1CRM platform. Paul and his team really know “Accounting”, know Salesforce and speak your language.

Geoff Young

They get Cloud Finance

Aedon have always been knowledgeable, open and straightforward to deal with, and they really get the Salesforce eco-system and it’s transformative potential. Their approach to combining CRM and finance capabilities in a single system is revolutionary – one of our most valuable partnerships!

Jyoti Hull-Jurkovic, CEO at Zentso

World Class Accounting solution seamlessly integrated with Salesforce

Aedon is a reliable and powerful accounting solution for any business, thanks to its seamless integration with Salesforce, user-friendly interface, robust reporting features, and top-notch security measures.

Daniel Ruthenberg, Account Director at Manras Technologies

Aedon.Accounting: Excellent Financial Management on Salesforce

The end-to-end automation of Revenue Operations sets Aedon.Accounting apart, making it an invaluable asset for businesses seeking a robust financial management solution within the Salesforce ecosystem. Highly recommended for those aiming to maximize efficiency and profitability.

Vladyslav Petrovych, CTO at Noltic

Complete Native Accounting Solution

Having a complete accounting solution on the platform really opens up possibilities for deep integration with other parts of your Salesforce application. Automating the financial aspects of Salesforce processes can really reduce manual input and correction.

Steve O’Connell, Founder at Kampango

Proud Aedon Implementation Partners!

Aedon stands out as the go-to choice for those seeking a streamlined and efficient Finance/Accounting solution on Salesforce – we are very proud implementation partners.

Tim Chisnall, Director at Cognition24

We really like the Aedon Accounting package

It is what it claims: Fast, Right, Cheap & Easy, which is refreshing given the complexity of some of the alternatives. A great product choice!

Ayesha Barton

Excellent Experience, and a great product.

A great accounting product here for Salesforce with lots of integration options. The Aedon team have really gone the extra mile with some excellent features to make your life easier. They truly understand their product and how its going to be used by the customer.

Chris Bell, CTO at Smarterpay

How it Works

Step #1: Sign Up

Step #2: Install

Step #3: Start Using

Step #1: Sign Up

Step #2: Install

Step #3: Start Using

Take Aedon.Accounting for a Quick Spin

Get in the driving seat with this short user-led introduction to Aedon.Accounting. Take the software for a quick spin to get a high level view of its top features, before signing up for our ‘Free Forever’ account where you can test the suitability of our Salesforce Accounting Solution until your heart’s content.

Frequently Asked Questions

Aedon.Accounting is an innovative, robust financial software solution that transforms the way you do accounting, inside Salesforce!

Answers to questions we’re commonly asked are provided below. Please use the filters to narrow down answers by category.

The short answer is that they want to scale. Successful franchises combine the entrepreneurial talents of the Franchisee with a proven operating model to grow a mutually symbiotic business.

It is less risky. Some studies indicate that around 90% of franchises are still operating after five years, compared to only about 20% of independent businesses.

The successful Franchise combines a strong brand identity with a proven business model, comprehensive training and support, efficient operating systems, effective marketing and strong franchisee relationships. On top of all of that they must remain nimble and change with their customers.

Carefully! It is a big commitment and should not be rushed. Do your research? Talk to the British Franchise Association. Talk to multiple Franchisors AND their Franchisees. But choose a franchise which plays to your personal strengths and that you enjoy.

Yes, the Franchisee must be entrepreneurial, motivated, an excellent communicator and sales person, but also and most importantly they must follow the Franchise model. Don’t go off-piste!

A hotel franchise can cost several millions of pounds. McDonalds or Subway is in the range of £500,000 to a million. Then there is virtually every prices point down to a £10,000 for a cleaning franchise or a low-cost supermarket.

The standard SME offerings from Xero, Sage and Quickbooks are not designed to scale and combine accounting information from multiple franchisees. Put simply, they don’t have the horsepower.

Salesforce is best known for being the world’s #1 CRM system for the 11 years running according to the International Data Corporation. What is less well known is that they were the commercial software on the Cloud and their platform provides astonishing technical capabilities.

If a Franchisor collects client receipts on behalf of the Franchisees and then deducts any fees before distributing the money back to them, best practice is to use an Escrow Bank Account. An Escrow Bank Account holds the money in trust on behalf of the Franchisees and its contents are owned by them, not the Franchisor.

Benchmarking is the technique of comparing Franchisees with each other using the most important Key Performance Indicators for the business. To make the benchmarking more meaningful, Franchisor may group Franchisees into different categories so that the comparisons carry more weight.

Under cash-based VAT, the VAT is only paid when an invoice is paid. On accruals it is paid when the invoice is received. These rules apply to both Sales and Purchase Invoices. Generally most small businesses will take the cashflow advantages of cash-based VAT until their turnover grows to greater than £1,350,000.

MDF stands for Marketing Development Funds. It’s essentially a pot of money that a franchisor makes available to its franchisees to help them with local marketing and advertising efforts.

There are 29 modules in the SORP. And they are in a somewhat random order! That is the bad news.

The good news is that for most charities there are 6 which are particularly important and these are highlighted below. The others you may need to refer to according to your specific circumstances.

| Module | Title | SORP Page |

|---|---|---|

| Core Modules | ||

| 1 | Trustees’ annual report | 12 |

| 2 | Fund accounting | 22 |

| 3 | Accounting standards, policies, concepts and principles, including the adjustment of estimates and errors |

29 |

| 4 | Statement of financial activities | 37 |

| 5 | Recognition of income, including legacies, grants and financial income | 50 |

| 6 | Donated good, facilities and services, including volunteers | 60 |

| 7 | Recognition of expenditure | 65 |

| 8 | Allocating costs by activity in the statement of financial activities | 72 |

| 9 | Disclosure of trustee and staff remuneration, related party and other transactions | 76 |

| 10 | Balance sheet | 82 |

| 11 | Impairment of assets | 98 |

| 12 | Analysis of grants | 105 |

| 13 | Events after the end of the reporting period | 109 |

| 14 | Statement of cash flows | 111 |

| Selection 1: Special Transactions relating to charity operations | ||

| 15 | Charities established under company law | 118 |

| 16 | Presentation and disclosure of grant-making activities | 122 |

| 17 | Retirement and post-employment benefits | 127 |

| Selection 2: Accounting for special types of assets held | ||

| 18 | Accounting for heritage assets | 131 |

| 19 | Accounting for funds received as agent or as custodian trustee | 138 |

| Selection 3: Accounting for investments | ||

| 20 | Total return (investments) | 141 |

| 21 | Accounting for social investments | 145 |

| 22 | Accounting for charities pooling funds for investment | 152 |

| Selection 4: Accounting for branches, charity groups and combinations | ||

| 23 | Overview of charity combinations | 155 |

| 24 | Accounting for groups and the preparation of consolidated accounts | 157 |

| 25 | Branches, linked or connected charities and joint arrangements | 164 |

| 26 | Charities as subsidiaries | 169 |

| 27 | Charity mergers | 170 |

| 28 | Accounting for associates | 174 |

| 29 | Accounting for joint ventures | 177 |

| Appendices | ||

| 1 | Glossary of Terms | 181 |

| 2 | The Charity Accounting (SORP) Committee | 194 |

| 3 | Thresholds for the UK and the Republic of Ireland | 195 |

| 4 | Basis for conclusions | 197 |

There are 21 Tables in the SORP and 2 figures. That is the bad news. The good news is that most don’t apply to most charities. The important ones are highlighted below.

| Table | Title | SORP Page |

|---|---|---|

| 1 | Outline summary of fund movements | 28 |

| 2 | Statement of financial activities | 38 |

| 3 | Analysis of expenditure on charitable activities | 48 |

| 4 | Analysis of support costs | 75 |

| 5 | Balance sheet | 83 |

| 6 | Analysis of opening and closing carrying amounts | 89 |

| 7 | Common basic financial instruments | 99 |

| 8 | Statement of cash flows | 115 |

| 9 | Reconciliation of net income/(expenditure) to net cash flow from operating activities | 116 |

| 10 | Analysis of cash and cash equivalents | 116 |

| 10a | Analysis of changes in net debt | 117 |

| 11 | Minimum requirements for a summary income and expenditure account | 120 |

| 12 | Analysis of grants | 124 |

| 13 | Analysis of charitable activities | 125 |

| 14 | Analysis of heritage assets | 135 |

| 15 | Summary analysis of heritage asset transactions | 137 |

| 16 | Example of the disclosure of a toral return approach to investment of permanent endowment | 143 |

| 17 | Analysis of fund movements for a pooling scheme | 153 |

| 18 | Analysis of principal SoFA components for the current reporting period | 173 |

| 19 | Analysis of principal SoFA components for the previous reporting period | 173 |

| 20 | Analysis of net assets at the date of merger | 173 |

| Figure | ||

|---|---|---|

| 1 | The classes of charitable funds | 22 |

| 2 | Guide to accounting for charity combinations | 156 |

Yes, the Account object is modified to include the Gift Aid declaration allowing a simple csv submission report to be created for donations received.

Yes, the Salesforce integration is made simple because of the shared Salesforce platform between Aedon.Accounting and the NPSP. Some configuration will be required to ensure that all the donation attributes are included as Analysis Codes in Aedon.Accounting.

Yes, the Salesforce integration is made simple because of the shared Salesforce platform between Aedon.Accounting and the Nonprofit Cloud. Some configuration will be required to ensure that all the donation attributes are included as Analysis Codes in Aedon.Accounting.

Aedon.Charities is an extension to the core Aedon.Accounting product. It is designed to add additional functionality which is specifically designed for the charity sector.

Aedon.Charities provides three main features:

- Compliance with the Charity SORP

- Integration with the Salesforce Nonprofit Cloud or the Nonprofit Success Pack (NPSP)

- Simple Gift Aid Submission.

The compliance with the Charity SORP includes the production of the three key financial statements:

- Statement of Financial Activities

- The Balance Sheet

- Statement of Cash Flow

Plus all the accompanying notes that are required to further analyse these three core reports.

The Salesforce integrations are made simple because of the shared Salesforce platform between Aedon.Accounting, the Nonprofit Cloud and NPSP. Some configuration will be required to ensure that all the donation attributes are included as Analysis Codes in Aedon.Accounting.

The Account object is modified to include the Gift Aid declaration allowing a simple csv submission report to be created for donations received.

The Charity’s activities are the means of achieving its charitable objectives. They are defined in the Trustee’s statement.

Unfortunately, although the initial definition is clear, the SORP then proceeds to use the term activity to also define the different classifications of income expenditure in a a very confusing manner.

It would have been much easier if they had used a different term such as “Classification”. This is how we define the different dimension axes that are necessary to comply with the SORP in what we refer to as 3-Dimensional Accounting.

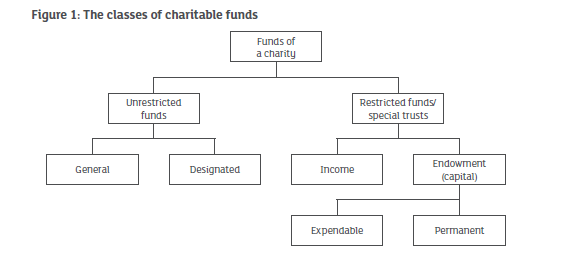

There are essentially two classes of fund: Unrestricted and Restricted.

Unrestricted funds can be applied for any of the charity’s activities. When they are set aside for a specific purpose, they are called Designated. The undesignated funds are called General.

Restricted Funds can be either Income Funds or Endowment Funds. Income funds can be spent in full on the activities defined by the donor. Endowment funds hold capital that can provide an income to be used for the charitable activities.

The Endowment funds are further divided into Permanent Endowments which are held indefinitely or Expendable Endowments in which the capital can be spent at the discretion of the trustees.

The SORP uses this diagram to explain the different types of funds.

Charities are not businesses and therefore create surpluses or deficits in their income and expenditure. These are accumulated year on year as fund, which are also described as reserves.

Under the Charity SORP the surpluses and deficits are recorded against each fund and then accumulated in the same way in the accumulated funds or reserves.

The Statement of Financial Activities is the charitable equivalent of a Profit & Loss report for ordinary businesses, which is extended by including balance sheet information for the movement in the funds.

It uses standard classifications of income and expense which are intended to assist with the comparison of different charities.

However, these classifications are then divided according to the different funds which they were paid out of making the whole report far too complex to read easily.

If the SOFA were an Olympic dive, it would have a degree of difficulty of 4.9 out of 5!

Three-dimensional accounting simplifies the implementation of the Charity SORP.

On every type of income (sales invoice) you record not only the classification of the income using the nominal or general ledger code for that income type, but also the fund that it goes into.

Then, for every purchase invoice you record not only they classification of the expenditure using the nominal code, but you record the activity it was spent on and the fund that is being used to pay for it.

In system terms you record the classification of the income or expenditure using the nominal codes, and then use the Fund analysis code to manage the balance in the fund and the Activity Analysis code to identify which activity is being supported.

Recording this extended information, which is necessary to comply with the Charity SORP, is simple with Aedon.Charities.

The SORP is extremely difficult to implement properly unless you have a multi-dimensional accounting system like Aedon.Accounting.

Most charities use starter packages which have a business-oriented chart of accounts that might allow for different departments or cost centres, but certainly don’ support the three-dimensional need to record the nominal code, fund and activity on all purchases. These simpler packages are simply not sophisticated enough to make compliance with the SORP easy.

However, help is at hand. We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

The SORP is extremely difficult to implement properly unless you have a multi-dimensional accounting system like Aedon.Accounting.

Most charities use starter packages which have a business-oriented chart of accounts that might allow for different departments or cost centres, but certainly don’ support the three-dimensional need to record the nominal code, fund and activity on all purchases. These simpler packages are simply not sophisticated enough to make compliance with the SORP easy.

However, help is at hand. We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

The SORP was created by some very clever and very experienced accountants, who were probably too clever and too experienced to recognise that what they had produced was far too complicated for charities many of whom rely on unqualified volunteers to fulfil their financial roles.

Even for experienced accountants the SORP is very daunting and made even more so by the ambiguities and problems in its construction.

The aim of the Financial Reporting Council is “to promote transparency and integrity in business”. With regards to charities the aim is to help readers understand three things in particular:

- What are the objectives of the charity?

- What activities does it undertake to achieve those objectives?

- How are those activities funded?

Unfortunately, it only partially meets those objectives. The list of requirements for the Trustee’s Report ensures a comprehensive narrative that explains the first objective of what the charity is trying to achieve and allows for a good description of the activities.

The financial statements are overly complex and unhelpful. The Statement Financial Affairs is the most important report in the SORP and is equivalent to a Profit & Loss Account with a summary balance sheet added at the end. Even experienced readers of accounts find it difficult to judge whether the charity is succeeding or failing.

Yes! There are some minor changes in the Trustee’s Report for “small” charities which are defined as those with a gross income of less than £500,000 for UK charities or €500,000 for Irish.

The Charity Statement of Recommended Practice is mandatory for all charities – regardless of size. It is a 200-page A4 document of additional reporting requirements that are layered on top of FRS 102.

Unfortunately, and unintentionally, the SORP is ambiguous and poorly written. Complying with the SORP creates financial reports which are overly complex and fail to inform the normal reader.

But that does not matter, although you may not like the SORP as a charity treasurer or advising accountant, you must comply with it. Sorry.

However, help is at hand. We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

Aedon.Accounting is compliant in accordance with ISO27001, FCA Regulations and is Officially Recognised by HMRC.

Aedon.Accounting Aedon has 4 Prebuilt RESTful endpoints that can be accessed to create transactions within Aedon.Accounting and can be accessed by any applications both on and off Salesforce platform.

Please email sales@aedon.co.

No, the Salesforce license and set-up is included in the price of Aedon.Accounting!

Yes, discounts are available for long term contracts and for large numbers (over 10 licenses). Not-for-Profits are also eligible for preferred rates.

Yes, one year.

By bank transfer. Details will be provided on your invoice.

Call us on 0161 262 3355 or email us on sales@aedon.co to discuss your specific requirements.

No, the license price is the only fee.

Yes, an account manager will be allocated to you.

Aedon is Salesforce-based and supports their chosen browser: Chrome, Safari, & Firefox.

Obviously, it depends on the complexity and size of the organization, but a VAT quarter works well for most implementations.

There is the Aedon.Assistance Knowledge Base and Aedon.Academy for training if you wish to DIY-it

Otherwise, there is a list of approved implementation partners available on the website.

There are migration templates available for most of the starter packages: Xero, Sage 50, etc. and specific support will be made available if there isn’t one available for your software.

Implementation support is available through partners, who generally are available to work on site?

The end of year or the end of a VAT quarter are natural migration points. However, you can changeover mid-month with a little bit of extra effort, if required.

No, Aedon is only available online although you can download the data in csv format.

Yes, there are 3 companies included as standard with the Business Class License, but unlimited companies can be added over that.

Yes, it works with all Salesforce apps natively and can be integrated to non-Salesforce apps via APIs.

Yes, it will support very large data volumes and numbers of users.

Yes, all Salesforce Apps are available in mobile format.

Experienced finance users will not need a lot of training. However, the Aedon.Academy which is free for a month with a new license provides a great grounding in the product

No, you can have as many users as you need. Each of them can have different access rights and permissions according to your need.

The Aedon.Assistance Knowledge Base includes a wide range of support articles. If it doesn’t answer your question email support@aedon.co and we will answer you (and then write an article to fill the gap!)

The Aedon.Academy for training provides an excellent grounding in the software and this is supported by the Aedon.Assistance Knowledge Base with detailed articles on all aspects of the software.

However, if neither of those work, human support is available on 0161 262 0300 or via email on support@aedon.co during UK office hours.

Yes, a company is either accruals or cash-based VAT.

Migrating from one method to the other will require assistance. So, contact support@aedon.co if that applies to you.

Yes, it will create VAT reports for both accruals and cash-based VAT but does not have automated submission.

Aedon will support any VAT or GST tax system. You will need to create a specific Tax Codes for the relevant rates and rules. In the likely event that you will support, please contact us on support@aedon.co.

Yes. The official term and the only term we are allowed to use is “HMRC recognised”. This means that we passed a range of technical tests and been reviewed and approved by HMRC themselves.

The answer is nothing! When the internet is restored, your accounting data will be safe and sound. All back-up and security measures are handled by Salesforce themselves to the highest available standards.

All back-up and security measures are handled by Salesforce themselves to the highest available standards.

Your security access and permissions are created by yourself or your Systems Implementation partner. Aedon.Co does not have access to your data.

Please contact us on support@aedon.co and we will cancel it for you. If this takes place in the first year, you will also receive a full refund of your license fees.

Please contact support@aedon.co.

You can do a full Salesforce Data Export which holds all your accounting and other Salesforce data.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

At sunt asperiores eos cumque officiis a quae placeat aut laborum consequatur. Et tenetur repellat et dicta sapientes ratione dolores ea facere suscipit.

Features & Versions

Full User: £95 Monthly

Reviewer: £25 Monthly

Additional Companies: £50 each

Salesforce Platform License Included

- Invoices, Credits & Payments on Account

- Bulk Postings

- Bulk Payments

- Revenue/Expense Recognition

- Scheduled Receipts & Payments

- Aged Receivables & Payables

- Multi-Currency

Automated Bank Reconciliation

- Bank Matching Rules

- CSV Bank Statement Upload

- Manual Journals

- UK & Irish VAT

- HMRC Recognised VAT Submission

- 10 Reporting Dimensions

- Statutory Financial Reports

- Top-Down Reporting & Dashboards

- Bottom-Up Reporting & Dashboards

- Salesforce Sales Cloud Integration

Single Company

- SmarterPay Direct Debits (Option)

- SmarterPay Bulk Payments (Option)

Plus:

Aedon.Academy

Aedon.Assistance – Email

Full User: £125 Monthly

Reviewer: £35 Monthly

Additional Companies: £50 each

Salesforce Platform License Included

Everything in Aedon.Essentials – PLUS

- Unlimited Budget Types

- Budget Journals

- Recurring Journals

- Recurring Invoices

- Yapily Bank Integration (5x daily)

3 Companies

- SmarterPay Direct Debits (Optional)

- SmarterPay Bulk Payments (Optional)

Plus:

Aedon.Academy

Aedon.Assistance – Telephone & Teams Support

Remote Access Support

Annual Healthcheck

Full User: £145 Monthly

Reviewer: £40 Monthly

Additional Companies: £50 each

10 Free Salesforce Cloud Licenses

Everything in Aedon.Accounting – PLUS

- SORP Fund Accounting (FRS 102)

- SORP Chart of Accounts

- Fund Dimension

- Activity Dimension

- Department Dimension

- SORP Statement of Financial Affairs

- SORP Balance Sheet

- SORP Statement of Cash Flows

- Fund Trial Balance

- Activity Trial Balance

- Salesforce NPSP Integration

- Salesforce Nonprofit Cloud Integration

3 Companies

- SmarterPay Direct Debits (Optional)

- SmarterPay Bulk Payments (Optional)

Plus:

Aedon.Academy

Aedon.Assistance – Telephone & Teams Support

Remote Access Support

Annual Healthcheck

Full User: £245 Monthly

Reviewer: £65 Monthly

Client: £12.50 Monthly

Additional Companies: £50 each

SF Experience Cloud Required

Everything in Aedon.Accounting – PLUS

- Client Bank Account (Escrow)

- Client Sales Invoices

- Client Sales Credits

- Client Purchase Invoices

- Client Fee Invoices

- Client Remittances

- Client Withdrawals

- Client Bank Transfers

- Client Statements

- Client VAT Filing

- HMRC Recognised VAT Submission

- Client Annual Tax Statements

3 Companies

- SmarterPay Direct Debits (Optional)

- SmarterPay Bulk Payments (Optional)

Plus:

Aedon.Academy

Aedon.Assistance – Telephone & Teams Support

Remote Access Support

Annual Healthcheck

Case Priority

Pay Annually and Save Up To 35%

Save 15% Paid Annually in Advance

Save 25% 2 Year Contract Paid Annually in Advance

Save 35% 3 Year Contract Paid Annually in Advance

Prices are subject to Aedon.co Limited’s Terms & Conditions.