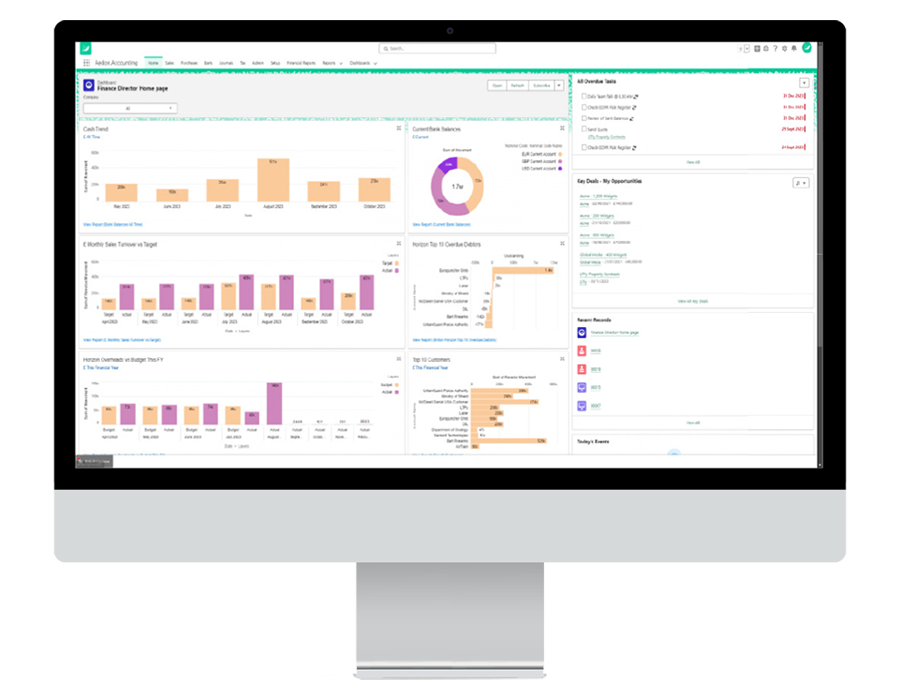

What is Aedon.Charities and how can it help me?

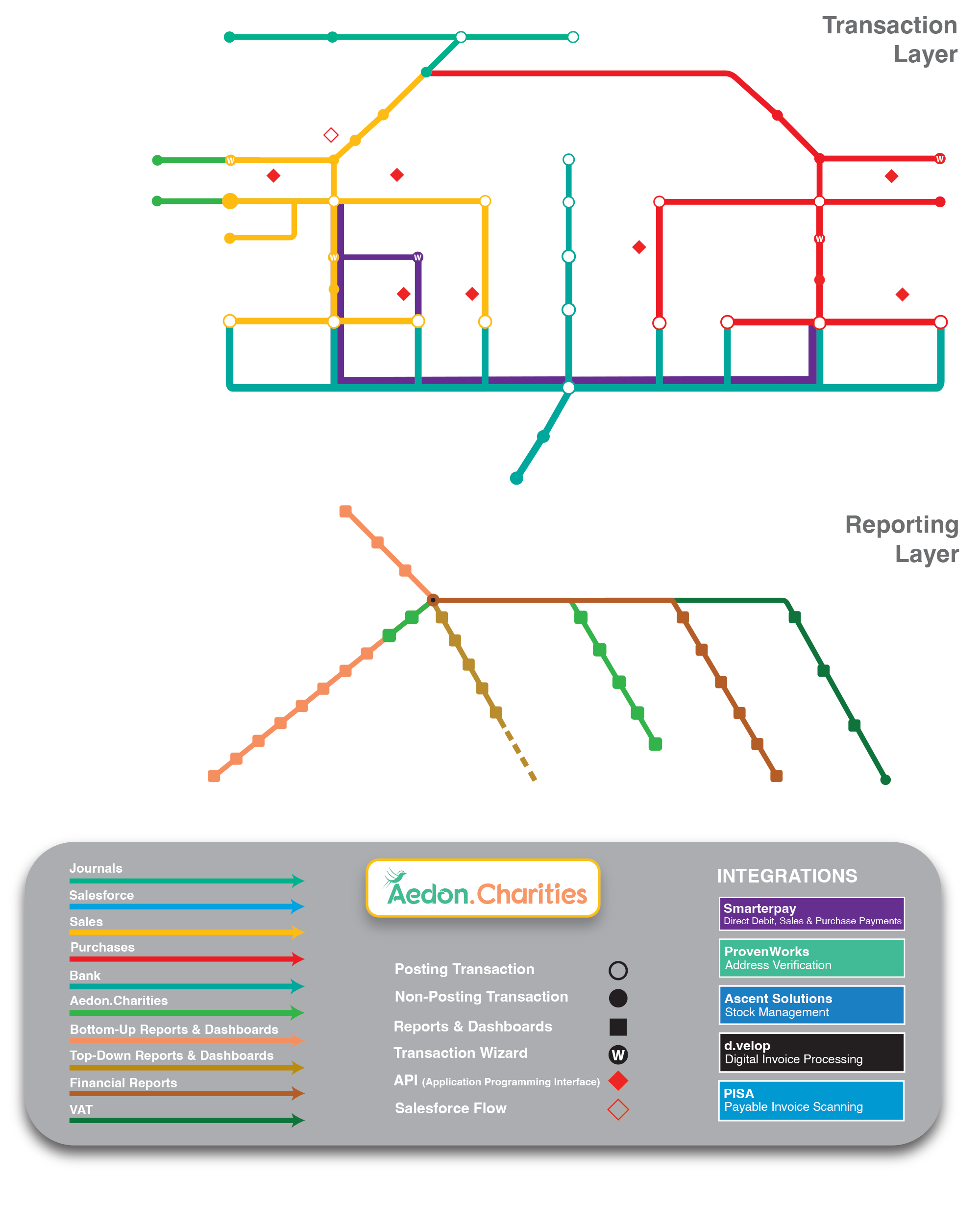

Aedon.Charities is a specialist charity finance package that is designed to comply with the fund accounting principles of the Charity Statement of Recommended Practice (FRS 102) as published in October 2019.

Aedon.Charities will produce:

- Statement of Financial Affairs

- Balance Sheet

- Statement of Cash Flows

Income and expenditure is classified according to the SORP notes and by fund type, together with the supporting tables and disclosures.

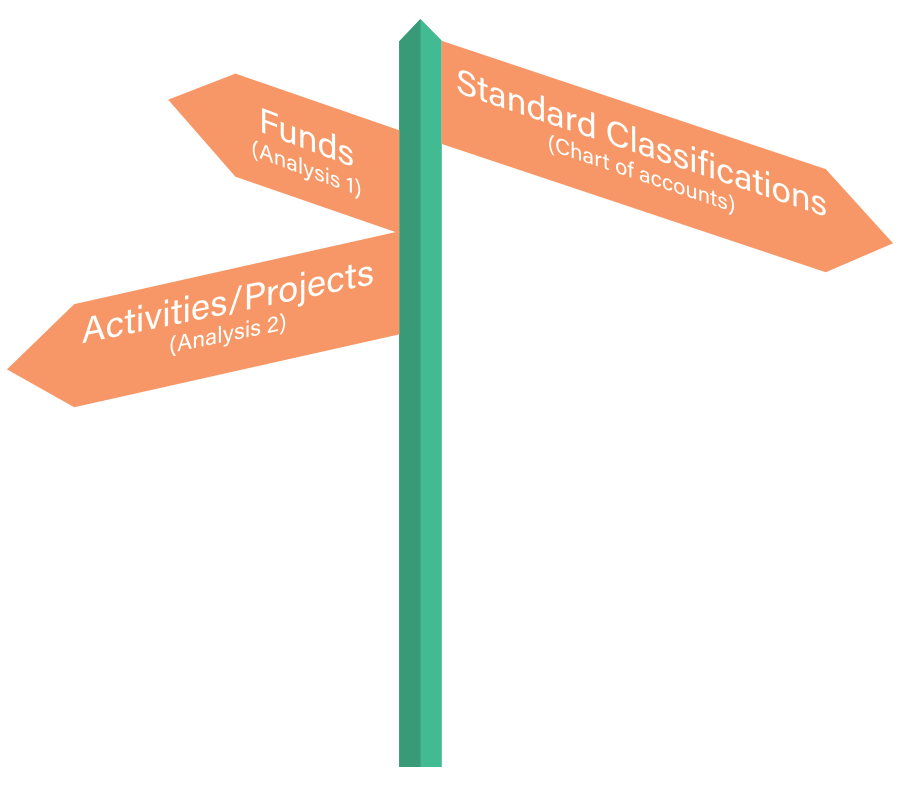

Included with the package is a SORP-compliant, multi-dimensional chart of accounts with dimensions for funds and activities.

For Salesforce users, Aedon.Charities offers integration with the Nonprofit Cloud and Nonprofit Service Pack (NPSP).

Learn more about Aedon.Accounting – the perfect accounting software for charities, particularly those already using Salesforce – below!

Already excited?

7 Accounting Challenges for Charities

Download the whitepaper today (instant access)

7 Accounting Challenges

For Charities

Download the whitepaper today

Download Now. Instant Access

Highlighting the key challenges you will face at a Charity/NFP that are different to those you would find in a normal commercial environment.

7 Reasons Aedon.Accounting is Perfect for Charities & NFPs

1. Complying with the Charity SORP

The Charity SORP imposes complex reporting requirements on charities, regardless of size.

The reporting questions focus on charity objectives, activities, and funding sources.

Many find the SORP format too complex for non-accountants to understand.

Implementing 3-dimensional accounting simplifies the process, coding every donation and expenditure with dimensions.

Simplifying financial reporting helps reduce costs, allowing for easier preparation of the Statement of Financial Activities, Balance Sheet, and Cash Flow.

The Charity SORP layers an incredibly onerous layer of additional reporting on all charities regardless of size. It is very long and very ambiguous. At its heart is a very simple set of questions:

- What are the objectives of charity

- What activities or projects does it undertake to achieve those objectives?

- How does it fund them?

Unfortunately, the format for the year end accounts that are required to answer these questions are far too complicated for most lay people to understand.

Aedon.Charities can’t correct the SORP, but it can make it easier to comply with and therefore reduce your year-end costs with your accountants by giving them the numbers in the format that they need them.

To deliver this simplification Aedon.Charities uses a technique which we call 3-Dimensional Accounting.

Every donation, gift or legacy is coded not only to a nominal code but also to a Fund using an Analysis Code. This requires 2 dimensions.

Every piece of expenditure however requires 3: the nominal code, the fund and the project or activity that it has been spent on. Governance and support costs are treated initially as a project before they are reallocated.

By using this technique, creating the information for the key SORP reports:

- Statement of Financial Activities

- Balances

- Cash Flow Statement

And associated notes are much easier and far less expensive than getting your accountant to do it for you.

2. Managing Multiple Stakeholders

- Charities must cater to the information needs of various stakeholders, including trustees, donors, and volunteers.

- Different stakeholders require tailored reports and dashboards specific to their interests.

- Aedon.Charities captures data using dimensions, allowing for the management of diverse reporting needs.

- Stakeholders can access customized dashboards with controlled access for GDPR compliance.

- Trustees use top-down dashboards for an overview, while donors and volunteers focus on bottom-up reports specific to their projects.

Every charity finance director has multiple parties asking for information in different ways:

- Trustees

- Donors

- Management Team

- Marketeers

- Volunteers

- HMRC

- Charity Commission

All of them have different questions and different information that is required to answer them. One set of management reports doesn’t really cut it, they each want their own view of the financial information that is relevant to them.

Aedon.Charities addresses this problem in two different ways. Firstly, it captures the necessary information when financial information is recorded using Analysis Objects. There are 10 of these and each can have 500 individual pieces of information, so there are 5,000 possible attributes that you can record – enough for the most demanding donor!

Secondly, Aedon.Charities allows you to create Management Information Dashboards that are specific to particular groups with controlled access using the Salesforce security model to ensure that GDPR constraints are properly adhered to.

The Trustees and Management Team typically use “Top-Down” dashboards to give them an overview of the charity and see how it is performing in the round.

Donors, Volunteers and Marketing want to know about their funds or their project and are much less concerned about the big picture. They will use “Bottom-Up” dashboards to look at their specific interest.

3. Reducing the Risk of Theft

- Charities are vulnerable to theft, costing the sector approximately £1.83 billion annually.

- Prevention strategies include clear policies, segregation of duties, regular training, and strong internal controls.

- Detection methods such as data analytics, regular reviews, and surprise audits help identify irregularities.

- Implementing robust cybersecurity measures and whistleblower protections further reduce risks.

- Timely investigation and disciplinary actions are key to responding to fraud incidents.

By implementing a comprehensive fraud prevention, detection, and response program, charities can significantly reduce their risk of fraud and protect their resources. Download our whitepaper above to learn more.

For further information and resources, you can visit Prevent Charity Fraud: https://preventcharityfraud.org.uk/.

4. The Importance of the Bank Reconciliation

- Regular bank reconciliations are essential for detecting fraud and ensuring accurate financial reporting.

- Reconciliation helps identify discrepancies between internal records and bank statements.

- It supports accurate tracking of restricted funds and cash flow management.

- Charities can ensure financial transparency and compliance through regular reconciliations.

- Automation of the reconciliation process with bank feeds and matching tools enhances efficiency and accuracy.

Specifically for charities, bank reconciliations can also help:

- Identify unrecorded donations or grants: Donations made directly to the bank account may not have been recorded in the charity’s accounting system.

- Track restricted funds: Charities often receive funds designated for specific purposes. Bank reconciliations can help track these restricted funds and ensure they are used appropriately.

- Monitor fundraising income: Bank reconciliations can help ensure that all fundraising income is accounted for and accurately reflected in the financial records.

Overall, the bank reconciliation process is an essential tool for ensuring financial health, accountability, and transparency in charities. By regularly reconciling bank statements, charities can safeguard their funds, maintain accurate financial records, and uphold the trust of their stakeholders.

Aedon.Charities supports an effective and efficient bank reconciliation process in several important ways:

- An automated bank feed five times per day to ensure it is always up to date

- Three types of matching:

– Bank Rules – Applying Boolean logic to identify close matches

– Open Invoices – Payments or receipts are matched unpaid donations or purchase invoices

– Existing Payments – Payments or receipts are matched to previously recorded payments such a s credit cards, cheques or Stripe payments - Bulk matching of up to 100 items at a time (provided they comply with the matching requirements)

- Clear audit trail from the bank statement to the Payment to the Invoice or Donation.

5. Managing With Part-Time Staff

- Part-time finance staff may create continuity and knowledge gaps, leading to delays in financial reporting.

- Limited availability and experience may increase the risk of errors and fraud.

- Clear communication channels, regular training, and strong internal controls help mitigate these risks.

- Part-time staff positions often see higher turnover, requiring frequent recruitment and training efforts.

- Properly managing part-time staff involves defining clear roles, ensuring oversight, and reviewing performance.

While part-time finance staff can be a cost-effective solution for charities, their inconsistent availability may lead to delays in financial processes, reporting, and decision-making, particularly during busy periods or when urgent matters arise. These staff members may also have limited interaction with other team members, leading to communication breakdowns, which can negatively affect collaboration and overall financial management. Additionally, part-time staff may require more supervision, which adds to the responsibilities of managers, especially if they have limited experience or work remotely.

Part-time roles can sometimes attract individuals with less depth of knowledge or experience compared to full-time professionals. This knowledge gap could result in errors in financial management, missed cost-saving opportunities, and weaker financial controls. Furthermore, part-time staff may not have the capacity to handle complex financial tasks or manage large workloads, potentially necessitating the outsourcing of certain activities or delaying key processes.

The nature of part-time work can also contribute to higher turnover rates, as these roles may be less appealing for professionals seeking long-term career growth. This turnover leads to increased recruitment and training costs. Moreover, the lack of continuous oversight, coupled with knowledge gaps, may increase the risk of financial irregularities or fraud, underscoring the need for strong internal controls and vigilant management practices.

Learn more when you download our whitepaper above.

6. Slaying the Monthly Reporting Pack

- Monthly Reporting Packs (MRPs) can be replaced with real-time reports and dashboards for efficiency.

- Identifying key metrics and KPIs ensures relevant data is captured for stakeholders.

- Interactive dashboards allow users to drill down into data dynamically for better decision-making.

- Automating data collection reduces manual effort, saving time and resources.

- The shift from paper reports to dashboards enhances transparency and improves financial visibility.

Replacing a Monthly Reporting Pack (MRP) with reports and dashboards can streamline information delivery, improve decision-making, and increase efficiency. To begin, it’s important to identify key metrics and KPIs by analysing the current MRP and gathering input from stakeholders to understand their specific reporting needs. Prioritising essential data points ensures that the new reports and dashboards focus on what matters most to different user groups.

Designing the dashboards involves using tools like Salesforce to create clear, concise reports that visualise data in a user-friendly format. Interactive dashboards allow users to explore, filter, and drill down into details based on their specific needs. Automating data collection further enhances efficiency by minimising manual tasks and ensuring timely information delivery. Once implemented, comprehensive training should be provided to ensure all users understand how to navigate and use the dashboards effectively.

Ongoing monitoring and updates ensure that reports remain accurate and relevant. The benefits of this approach include real-time insights, improved collaboration, reduced manual effort, and significant cost savings by eliminating printed reports. By adopting this system, charities can foster a data-driven culture, allowing for faster decision-making and more efficient use of resources.

Learn more when you download our whitepaper above.

7. Keeping Your Data Secure

- Data security is critical for charities, especially with GDPR compliance.

- Role hierarchy and controlled access ensure that sensitive data is only accessible to authorized personnel.

- Encrypting data and utilizing data masking techniques help protect sensitive information.

- Regular security audits, event monitoring, and Salesforce security tools help identify and mitigate risks.

- Ongoing training and awareness campaigns reinforce data security practices among staff and volunteers.

Aedon.Charities, built on Salesforce, allows charities to secure and manage data in compliance with GDPR. It provides robust data governance through role hierarchies, granular profile permissions, sharing rules, and field-level security, ensuring that users have access only to the necessary information. Salesforce’s Shield Platform Encryption and data masking techniques further enhance security by encrypting sensitive information and protecting data in testing environments. Data retention policies and minimisation practices help limit the storage of unnecessary data, ensuring personal information is handled responsibly.

The platform also supports consent management by enabling the tracking of individual consents and maintaining detailed consent histories. Security audits and event monitoring ensure ongoing protection, allowing organisations to identify vulnerabilities and monitor unauthorised access attempts. Salesforce Shield and GDPR-specific apps enhance compliance by offering tools for encryption, audit trails, and data anonymisation.

Regular staff training, awareness campaigns, and a comprehensive data breach response plan are vital components of the system. These initiatives ensure that staff are familiar with GDPR best practices, data protection protocols, and the steps required to respond to a potential data breach, safeguarding the organisation’s integrity.

Aedon.Charities – Your Questions Answered

Aedon.Charities is an innovative, robust financial software solution that transforms the way you do accounting, inside Salesforce!

Aedon.Accounting Aedon has 4 Prebuilt RESTful endpoints that can be accessed to create transactions within Aedon.Accounting and can be accessed by any applications both on and off Salesforce platform.

The Charity Statement of Recommended Practice is mandatory for all charities – regardless of size. It is a 200-page A4 document of additional reporting requirements that are layered on top of FRS 102.

Unfortunately, and unintentionally, the SORP is ambiguous and poorly written. Complying with the SORP creates financial reports which are overly complex and fail to inform the normal reader.

But that does not matter, although you may not like the SORP as a charity treasurer or advising accountant, you must comply with it. Sorry.

However, help is at hand. We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

Yes! There are some minor changes in the Trustee’s Report for “small” charities which are defined as those with a gross income of less than £500,000 for UK charities or €500,000 for Irish.

The aim of the Financial Reporting Council is “to promote transparency and integrity in business”. With regards to charities the aim is to help readers understand three things in particular:

- What are the objectives of the charity?

- What activities does it undertake to achieve those objectives?

- How are those activities funded?

Unfortunately, it only partially meets those objectives. The list of requirements for the Trustee’s Report ensures a comprehensive narrative that explains the first objective of what the charity is trying to achieve and allows for a good description of the activities.

The financial statements are overly complex and unhelpful. The Statement Financial Affairs is the most important report in the SORP and is equivalent to a Profit & Loss Account with a summary balance sheet added at the end. Even experienced readers of accounts find it difficult to judge whether the charity is succeeding or failing.

The SORP was created by some very clever and very experienced accountants, who were probably too clever and too experienced to recognise that what they had produced was far too complicated for charities many of whom rely on unqualified volunteers to fulfil their financial roles.

Even for experienced accountants the SORP is very daunting and made even more so by the ambiguities and problems in its construction.

The SORP is extremely difficult to implement properly unless you have a multi-dimensional accounting system like Aedon.Accounting.

Most charities use starter packages which have a business-oriented chart of accounts that might allow for different departments or cost centres, but certainly don’ support the three-dimensional need to record the nominal code, fund and activity on all purchases. These simpler packages are simply not sophisticated enough to make compliance with the SORP easy.

However, help is at hand. We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

The SORP is extremely difficult to implement properly unless you have a multi-dimensional accounting system like Aedon.Accounting.

Most charities use starter packages which have a business-oriented chart of accounts that might allow for different departments or cost centres, but certainly don’ support the three-dimensional need to record the nominal code, fund and activity on all purchases. These simpler packages are simply not sophisticated enough to make compliance with the SORP easy.

However, help is at hand. We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

Three-dimensional accounting simplifies the implementation of the Charity SORP.

On every type of income (sales invoice) you record not only the classification of the income using the nominal or general ledger code for that income type, but also the fund that it goes into.

Then, for every purchase invoice you record not only they classification of the expenditure using the nominal code, but you record the activity it was spent on and the fund that is being used to pay for it.

In system terms you record the classification of the income or expenditure using the nominal codes, and then use the Fund analysis code to manage the balance in the fund and the Activity Analysis code to identify which activity is being supported.

Recording this extended information, which is necessary to comply with the Charity SORP, is simple with Aedon.Charities.

The Statement of Financial Activities is the charitable equivalent of a Profit & Loss report for ordinary businesses, which is extended by including balance sheet information for the movement in the funds.

It uses standard classifications of income and expense which are intended to assist with the comparison of different charities.

However, these classifications are then divided according to the different funds which they were paid out of making the whole report far too complex to read easily.

If the SOFA were an Olympic dive, it would have a degree of difficulty of 4.9 out of 5!

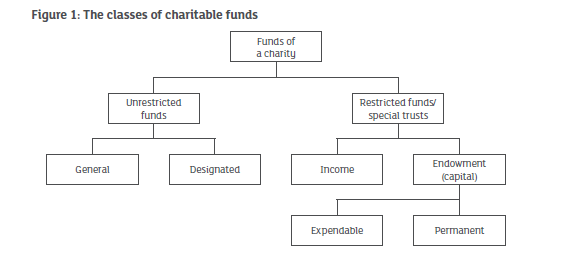

Charities are not businesses and therefore create surpluses or deficits in their income and expenditure. These are accumulated year on year as fund, which are also described as reserves.

Under the Charity SORP the surpluses and deficits are recorded against each fund and then accumulated in the same way in the accumulated funds or reserves.

There are essentially two classes of fund: Unrestricted and Restricted.

Unrestricted funds can be applied for any of the charity’s activities. When they are set aside for a specific purpose, they are called Designated. The undesignated funds are called General.

Restricted Funds can be either Income Funds or Endowment Funds. Income funds can be spent in full on the activities defined by the donor. Endowment funds hold capital that can provide an income to be used for the charitable activities.

The Endowment funds are further divided into Permanent Endowments which are held indefinitely or Expendable Endowments in which the capital can be spent at the discretion of the trustees.

The SORP uses this diagram to explain the different types of funds.

The Charity’s activities are the means of achieving its charitable objectives. They are defined in the Trustee’s statement.

Unfortunately, although the initial definition is clear, the SORP then proceeds to use the term activity to also define the different classifications of income expenditure in a a very confusing manner.

It would have been much easier if they had used a different term such as “Classification”. This is how we define the different dimension axes that are necessary to comply with the SORP in what we refer to as 3-Dimensional Accounting.

Aedon.Charities is an extension to the core Aedon.Accounting product. It is designed to add additional functionality which is specifically designed for the charity sector.

Aedon.Charities provides three main features:

- Compliance with the Charity SORP

- Integration with the Salesforce Nonprofit Cloud or the Nonprofit Success Pack (NPSP)

- Simple Gift Aid Submission.

The compliance with the Charity SORP includes the production of the three key financial statements:

- Statement of Financial Activities

- The Balance Sheet

- Statement of Cash Flow

Plus all the accompanying notes that are required to further analyse these three core reports.

The Salesforce integrations are made simple because of the shared Salesforce platform between Aedon.Accounting, the Nonprofit Cloud and NPSP. Some configuration will be required to ensure that all the donation attributes are included as Analysis Codes in Aedon.Accounting.

The Account object is modified to include the Gift Aid declaration allowing a simple csv submission report to be created for donations received.

Yes, the Salesforce integration is made simple because of the shared Salesforce platform between Aedon.Accounting and the Nonprofit Cloud. Some configuration will be required to ensure that all the donation attributes are included as Analysis Codes in Aedon.Accounting.

Yes, the Salesforce integration is made simple because of the shared Salesforce platform between Aedon.Accounting and the NPSP. Some configuration will be required to ensure that all the donation attributes are included as Analysis Codes in Aedon.Accounting.

Yes, the Account object is modified to include the Gift Aid declaration allowing a simple csv submission report to be created for donations received.

We are publishing the “The Plain English Guide to Implementing the Charity SORP” at the end of the year with a RRP of £20.

There are 21 Tables in the SORP and 2 figures. That is the bad news. The good news is that most don’t apply to most charities. The important ones are highlighted below.

| Table | Title | SORP Page |

|---|---|---|

| 1 | Outline summary of fund movements | 28 |

| 2 | Statement of financial activities | 38 |

| 3 | Analysis of expenditure on charitable activities | 48 |

| 4 | Analysis of support costs | 75 |

| 5 | Balance sheet | 83 |

| 6 | Analysis of opening and closing carrying amounts | 89 |

| 7 | Common basic financial instruments | 99 |

| 8 | Statement of cash flows | 115 |

| 9 | Reconciliation of net income/(expenditure) to net cash flow from operating activities | 116 |

| 10 | Analysis of cash and cash equivalents | 116 |

| 10a | Analysis of changes in net debt | 117 |

| 11 | Minimum requirements for a summary income and expenditure account | 120 |

| 12 | Analysis of grants | 124 |

| 13 | Analysis of charitable activities | 125 |

| 14 | Analysis of heritage assets | 135 |

| 15 | Summary analysis of heritage asset transactions | 137 |

| 16 | Example of the disclosure of a toral return approach to investment of permanent endowment | 143 |

| 17 | Analysis of fund movements for a pooling scheme | 153 |

| 18 | Analysis of principal SoFA components for the current reporting period | 173 |

| 19 | Analysis of principal SoFA components for the previous reporting period | 173 |

| 20 | Analysis of net assets at the date of merger | 173 |

| Figure | ||

|---|---|---|

| 1 | The classes of charitable funds | 22 |

| 2 | Guide to accounting for charity combinations | 156 |

There are 29 modules in the SORP. And they are in a somewhat random order! That is the bad news.

The good news is that for most charities there are 6 which are particularly important and these are highlighted below. The others you may need to refer to according to your specific circumstances.

| Module | Title | SORP Page |

|---|---|---|

| Core Modules | ||

| 1 | Trustees’ annual report | 12 |

| 2 | Fund accounting | 22 |

| 3 | Accounting standards, policies, concepts and principles, including the adjustment of estimates and errors |

29 |

| 4 | Statement of financial activities | 37 |

| 5 | Recognition of income, including legacies, grants and financial income | 50 |

| 6 | Donated good, facilities and services, including volunteers | 60 |

| 7 | Recognition of expenditure | 65 |

| 8 | Allocating costs by activity in the statement of financial activities | 72 |

| 9 | Disclosure of trustee and staff remuneration, related party and other transactions | 76 |

| 10 | Balance sheet | 82 |

| 11 | Impairment of assets | 98 |

| 12 | Analysis of grants | 105 |

| 13 | Events after the end of the reporting period | 109 |

| 14 | Statement of cash flows | 111 |

| Selection 1: Special Transactions relating to charity operations | ||

| 15 | Charities established under company law | 118 |

| 16 | Presentation and disclosure of grant-making activities | 122 |

| 17 | Retirement and post-employment benefits | 127 |

| Selection 2: Accounting for special types of assets held | ||

| 18 | Accounting for heritage assets | 131 |

| 19 | Accounting for funds received as agent or as custodian trustee | 138 |

| Selection 3: Accounting for investments | ||

| 20 | Total return (investments) | 141 |

| 21 | Accounting for social investments | 145 |

| 22 | Accounting for charities pooling funds for investment | 152 |

| Selection 4: Accounting for branches, charity groups and combinations | ||

| 23 | Overview of charity combinations | 155 |

| 24 | Accounting for groups and the preparation of consolidated accounts | 157 |

| 25 | Branches, linked or connected charities and joint arrangements | 164 |

| 26 | Charities as subsidiaries | 169 |

| 27 | Charity mergers | 170 |

| 28 | Accounting for associates | 174 |

| 29 | Accounting for joint ventures | 177 |

| Appendices | ||

| 1 | Glossary of Terms | 181 |

| 2 | The Charity Accounting (SORP) Committee | 194 |

| 3 | Thresholds for the UK and the Republic of Ireland | 195 |

| 4 | Basis for conclusions | 197 |

“Aedon is a reliable and powerful accounting solution for any business, thanks to its seamless integration with Salesforce, user-friendly interface, robust reporting features, and top-notch security measures.”

Daniel Ruthenberg, Account Director at Manras Technologies

Why Charities Need Aedon.Accounting

Why Charities Need Aedon.Accounting

Full Power of the Salesforce Platform

Aedon.Accounting is hosted on Salesforce allowing you to either connect your existing CRM directly with your accounting or upgrade to a true Cloud Finance Solution.

Full Compliance with the Charity SORP

We can’t correct the SORP, but we make it easier to comply with and reducing costs by giving accountants what they need.

Easily Manage Multiple Stakeholders

Every charity finance director has multiple parties asking for information in different ways, Aedon.Charities eliminates this by design with using Analysis Objects and unique Bottom-Up Reports.

Increased Security & Reduced Risk of Theft

Bank transactions are fed five times per day to an automated bank reconciliation, including matching rules and payment of open invoices.

Intelligent Bank Reconciliation

Aedon.Accounting has a powerful automated bank feed with intelligent and customisable matching rules to save you time and money.

Direct Debit & Payment Integration

Automated handling of direct debit payments and collections including failures.

Automated Processes & Approvals

Thanks to Salesforce’s powerful automation suite, we can empower your finance team by automating the mundane, daily, weekly, monthly tasks.

Native Reports & Dashboards

Reporting is Salesforce’s bread and butter, no more exporting your reports to Excel! View and create any report, chart, or graph within Aedon.Accounting.

Bottom-Up Reporting

This unique feature allows you to have a complete insight of your business at your fingertips, it allows precise reporting on Job Numbers, Products or any Analysis Code you want.

Integrate with Our SI Partners

When integrating Aedon.Accounting with Salesforce, utilising a Systems Implementation (SI) Partner can be helpful for ensuring a smooth and effective transition.

Why choose to work with an SI Partner?

Complex Integration: Aedon.Accounting is a powerful accounting solution that requires careful integration with Salesforce. An SI Partner can handle the complexities of data mapping, workflow adjustments, and security considerations when migrating your accounting systems.

Customisation: SI Partners can help customise Aedon.Accounting to fit your specific business processes and requirements, ensuring a seamless integration and maximising the functionality of Salesforce.

Best Practices: SI Partners are familiar with industry best practices for accounting package integrations and often have many certified individuals on-hand, helping you avoid common pitfalls and optimise your implementation.

Support and Maintenance: An SI Partner can provide ongoing support, maintenance, and updates to ensure your Aedon.Accounting integration remains effective, up-to-date and grows with your business.

Risk Mitigation: By working with an SI Partner, you can reduce the risk of errors, delays, and costly mistakes during the implementation process. Ensuring that your migration is handled as smoothly and effectively as possible.

What others are saying

Customer reviews

Aedon.Accounting combines CRM and finance to drive down costs and increase revenues PLUS all the customisation that Salesforce enables. Learn more on our Salesforce AppExchange page.

These are all genuine customer experiences shared by users of Aedon.Accounting on our Salesforce AppExchange page. Click below to learn more.

Accounting Solution native to Salesforce

The team have worked tirelessly to understand what customers really need from a finance/accounting solution that works seamlessly on the Salesforce Platform. Aedon is built on Salesforce and so leverages all the awesome core functionality offered by the worlds #1CRM platform. Paul and his team really know “Accounting”, know Salesforce and speak your language.

Geoff Young

They get Cloud Finance

Aedon have always been knowledgeable, open and straightforward to deal with, and they really get the Salesforce eco-system and it’s transformative potential. Their approach to combining CRM and finance capabilities in a single system is revolutionary – one of our most valuable partnerships!

Jyoti Hull-Jurkovic, CEO at Zentso

World Class Accounting solution seamlessly integrated with Salesforce

Aedon is a reliable and powerful accounting solution for any business, thanks to its seamless integration with Salesforce, user-friendly interface, robust reporting features, and top-notch security measures.

Daniel Ruthenberg, Account Director at Manras Technologies

Aedon.Accounting: Excellent Financial Management on Salesforce

The end-to-end automation of Revenue Operations sets Aedon.Accounting apart, making it an invaluable asset for businesses seeking a robust financial management solution within the Salesforce ecosystem. Highly recommended for those aiming to maximize efficiency and profitability.

Vladyslav Petrovych, CTO at Noltic

Complete Native Accounting Solution

Having a complete accounting solution on the platform really opens up possibilities for deep integration with other parts of your Salesforce application. Automating the financial aspects of Salesforce processes can really reduce manual input and correction.

Steve O’Connell, Founder at Kampango

Proud Aedon Implementation Partners!

Aedon stands out as the go-to choice for those seeking a streamlined and efficient Finance/Accounting solution on Salesforce – we are very proud implementation partners.

Tim Chisnall, Director at Cognition24

We really like the Aedon Accounting package

It is what it claims: Fast, Right, Cheap & Easy, which is refreshing given the complexity of some of the alternatives. A great product choice!

Ayesha Barton

Excellent Experience, and a great product.

A great accounting product here for Salesforce with lots of integration options. The Aedon team have really gone the extra mile with some excellent features to make your life easier. They truly understand their product and how its going to be used by the customer.

Chris Bell, CTO at Smarterpay