Big Changes for Small Charities: What the 2026 Draft SORP Means for You

Published:29 May 2025

If you’re involved in running a charity—especially a smaller one—there’s a big change on the horizon: a new Statement of Recommended Practice (SORP) is coming. In fact, it becomes mandatory for financial statements from 1st January 2026. That’s just around the corner.

So, What’s New?

The draft version of the SORP was published at the end of March, and the final round of consultations is now underway. Aedon.Accounting joined the Charity Finance Group roundtables earlier this month to discuss the changes. While the conversation was thoughtful and engaging, let’s be honest—at this point, most tweaks will be cosmetic. That is, with one important exception, which we’ll get to shortly.

Tiered Reporting: A Simpler System for Smaller Charities

One of the most significant changes is the introduction of tiers based on income:

Tier 1: Charities with income under £500,000 (or €500,000 in Ireland)

Tier 2: Up to £15 million (€15 million)

Tier 3: Over £15 million

This tiering system brings clarity—and, crucially for smaller charities, less red tape.

What Tier 1 Charities Can (Thankfully) Skip

Tier 1 charities will be exempt from some of the more demanding disclosure requirements, particularly in the Trustee’s Report. For example, you won’t need to report on Environmental, Social and Governance (ESG) issues—an area that’s currently high-profile but often overwhelming for small, volunteer-run organisations.

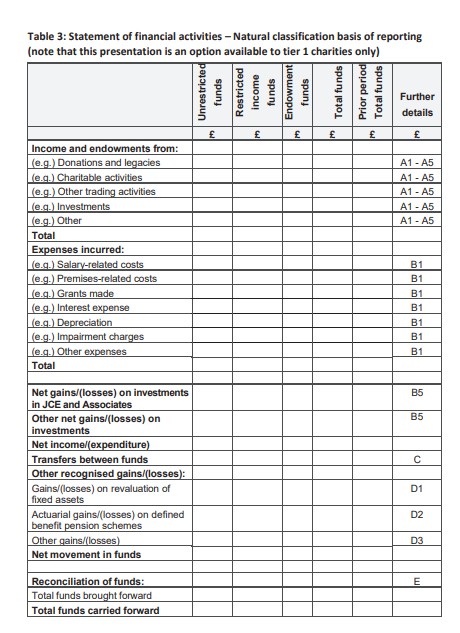

A Simpler SoFA (Sort Of)

Another notable update is around the Statement of Financial Activities (SoFA). The draft SORP introduces a defined layout for the “Natural Classification” format, which—despite the name—can still be tricky. You’ll need to show income and expenses by fund type, but you can skip allocating support costs (which many find confusing anyway). It’s still accounting, but it’s a step in the right direction for simplicity.

We’ve included a sample of the new format at the end of this article for reference.

303 Pages… Really?

One point that got unanimous support at the roundtable: small charities need their own version of the SORP. The current draft runs to 303 pages—a doorstop of a document, intimidating even for seasoned accountants. For volunteer treasurers trying to do the right thing on a Tuesday evening with a cup of tea and a spreadsheet? It’s a non-starter.

We’re hopeful the SORP committee takes this to heart. Time will tell.

How Aedon Can Help

Whether you’re a Tier 1 charity or managing more complex finances, Aedon.Charities—our SORP-compliant software—supports both Natural Classification and Activity-Based SoFA formats, complete with matching balance sheets. It’s designed with real-world charities in mind: intuitive, accurate, and built to scale with you.

Learn more at our dedicated Aedon.Charities page.