Navigating the New Era of Charity Reporting: A Look at the 2026 Draft SORP

Published:24 June 2025

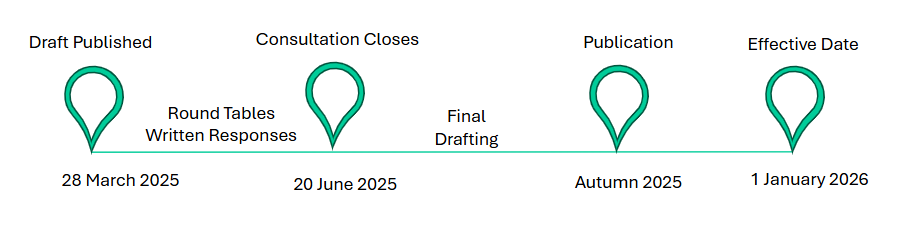

The Charity Statement of Recommended Practice (SORP) is entering a transformative phase. A new draft version—set to take effect in January 2026—proposes the most significant changes in years, and it’s essential that charities start preparing now.

Why It Matters

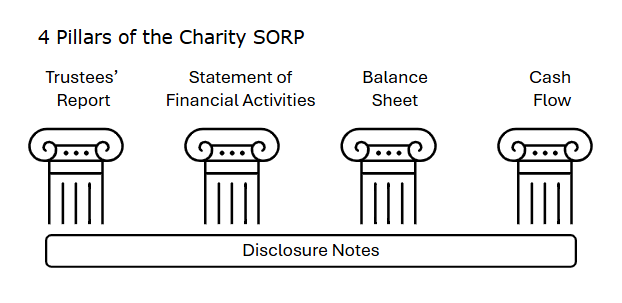

The SORP is the non-statutory framework that guides charity accounting in the UK and Ireland. It underpins how charities present their finances and activities, shaping how stakeholders understand and trust what they do. The 2026 Charity SORP draft seeks to modernise this framework—reflecting the complexity of today’s landscape and the growing need for transparency.

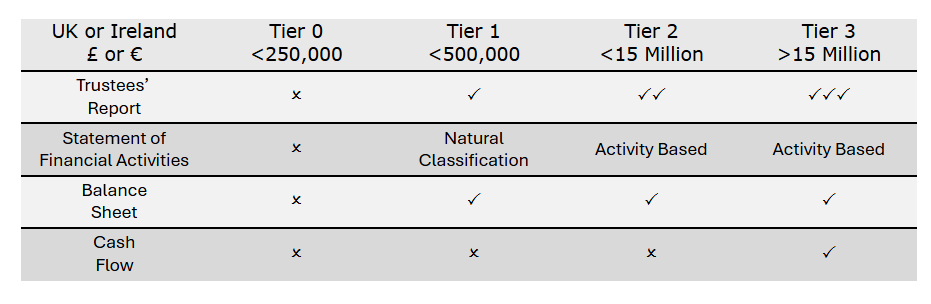

A New Tiered Approach

The most visible shift is a tiered system of reporting, where requirements scale depending on the size and complexity of the organisation. This makes perfect sense in a sector as varied as ours. Under the new draft, charities with income under £1.5 million (Tiers 1 and 2) will no longer need to submit a cash flow statement—freeing smaller organisations from unnecessary admin while ensuring larger ones still meet robust standards.

Narrative, Not Just Numbers

The Trustees’ Annual Report is evolving too. The draft places greater emphasis on non-financial disclosures—highlighting a charity’s impact, plans, and the essential role of volunteers. This is about telling the full story of what a charity achieves, not just how it spends.

Perhaps most notably, there’s a new requirement to report on sustainability and ESG (environmental, social, and governance) issues. This isn’t just a nod to modern trends—it reflects real stakeholder expectations and allows charities to demonstrate ethical leadership in a fast-changing world.

Technical Shifts, Real Implications

Other updates—driven by FRS 102—include a revised five-step model for revenue recognition and updates to lease accounting. These aren’t just technicalities; they’ll directly affect how charities record and interpret income, contracts, and obligations.

What To Do Next

Preparation is key. Charities should start by reviewing how they’ll gather ESG and volunteer data, assess their contracts, and re-examine lease arrangements. Don’t forget: comparative data is required, so previous years may need restating.

This draft SORP invites charities to not only meet new standards—but to elevate how they communicate value, purpose, and impact. At Aedon.Accounting, we’re here to support that shift. Contact us today or book a demo to find out how we can help you navigate the new SORP – before it arrives.

Our dedicated Charity SORP page has all you need to know, and our Aedon.Charities software has been specifically designed with charity treasurers in mind.