Charity Accounting Software

7 Accounting Challenges

For Charities

Download the whitepaper today

Built for the next era of charity accounting

What is Aedon.Charities?

Charity finance teams are under pressure to produce clearer disclosures, faster reporting and cleaner fund data than ever before. With SORP 2026 now here – and more changes expected in future cycles – many charities have outgrown spreadsheets and generic accounting tools that weren’t built for fund accounting.

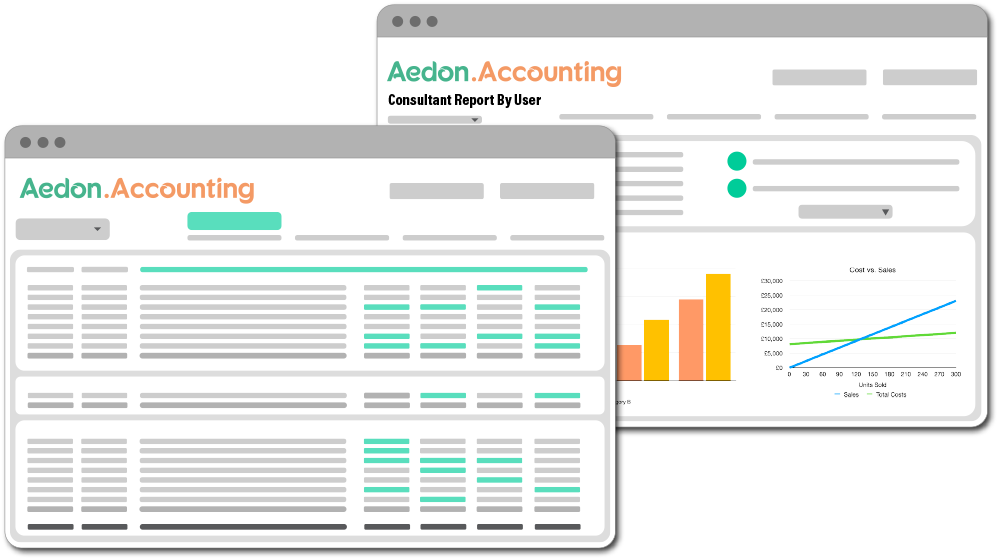

Aedon.Charities is a specialist accounting platform for UK charities turning over £500k+ per year. It keeps every financial record structured for today’s SORP – and automatically aligned with tomorrow’s.

Powered by Salesforce, it gives charities a new way of working: one where compliance is a by-product of clean data, not a frantic year-end exercise.

Key capabilities of Aedon.Charities non-profit accounting software

Ready for SORP 2026 and beyond

Financial statements, disclosures and fund structures already mapped, with updates delivered automatically whenever the standard evolves.

Track every pound by fund, project or donor

Multi-dimensional coding ensures restricted income, grants and appeals never get mixed.

Reduce manual work and errors

One reliable home for transactions, allocations, notes and reporting.

Everyone sees the same truth

Trustees, finance teams, fundraisers and auditors work from one consistent set of numbers.

Powered by Salesforce

Enterprise-grade security, integrations and scalability for charities without the enterprise price tag.

Clear budgeting for every fund

Create, track and review fund-level budgets without juggling spreadsheets or manual calculations.

“Working with Paul, Sri, and the entire Aedon team has been an exceptional experience. The technology has revolutionised our start-up, elevating our services to levels we previously could only dream of. But beyond the platform, it’s the care, expertise, and unwavering support from the team that truly sets Aedon apart from other partners.”

Generate Connect, Aedon.Accounting Partner

Trusted delivery with our SI Partners

Our SI Partners bring deep experience in the UK non-profit sector and understand the day-to-day realities of charity finance and SORP reporting.

Why charities switch to Aedon.Charities

Here’s why UK charities choose a platform built for fund accounting and SORP compliance from day one.

Who is Aedon.Charities is built for?

Aedon.Charities is designed for UK organisations that depend on transparent fund management, accurate grant tracking and clear SORP reporting.

Whether your work spans communities, education, arts, health, faith or international development, the platform adapts to your structure – not the other way around.

Aedon.Charities is ideal for:

Because these organisations rely on clean fund balances, transparent reporting and trust from donors and regulators, Aedon.Charities keeps everything SORP-ready every day.

Features Charities and Non-profit organisations will love

From fund control to audit readiness, these are the Aedon.Accounting features charity teams rely on most.

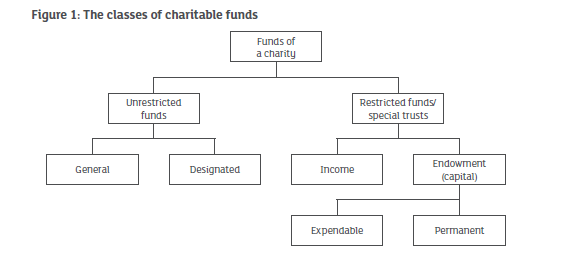

Live visibility over every restricted, designated and unrestricted fund keeps your organisation compliant and confident.

Aedon.Charities updates balances continuously, ensuring you never lose sight of grant conditions, donor restrictions or project spending. This reduces errors, protects reputation and keeps trustees fully informed.

Financial statements, notes and disclosures are pre-structured for SORP 2026, with future updates delivered automatically.

Year-end becomes smoother, faster and far less dependent on external consultants.

With Aedon.Accounting, your charity or non-profit can spend more time improving impact and less time preparing paperwork.

Connect financial data with donor income, grant milestones and project outcomes. See what’s been spent, what’s been pledged and what remains unallocated.

Fundraisers, project leads and finance teams finally get a unified view of every commitment.

Protect sensitive financial and donor information with industry-leading audit trails, permissions and data safeguards.

Every transaction is logged and traceable, and weekly automated backups keep your information safe, secure and ready for audit review.

Aedon.Charities – Your Questions Answered

Aedon.Charities is an innovative, robust financial software solution that transforms the way you do accounting, inside Salesforce!

What others are saying

Customer reviews

Aedon.Accounting combines CRM and finance to drive down costs and increase revenues PLUS all the customisation that Salesforce enables. Learn more on our Salesforce AppExchange page.

These are all genuine customer experiences shared by users of Aedon.Accounting on our Salesforce AppExchange page. Click below to learn more.

See Aedon.Charities in Action

Book a Demo with a Difference