Charity Statement of Recommended Practice (SORP)

Simple, Compliant Charity SORP Accounting on Salesforce

Aedon.Accounting helps charities meet SORP requirements effortlessly with clear reporting, strong audit trails and automated workflows – all inside your existing Salesforce environment.

With SORP compliance often complex and time-consuming, Aedon.Accounting gives charities a clearer, simpler way to record, allocate and report financial information – without spreadsheets, manual adjustments or external tools.

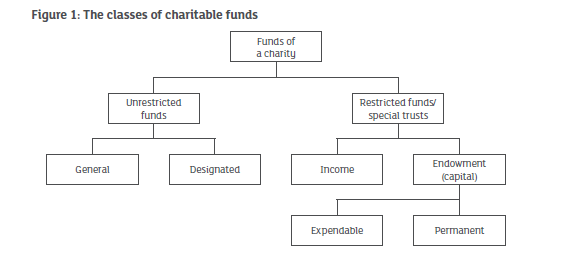

Designing a Multi-Dimensional Chart of Accounts for the Charity SORP

Download the whitepaper today

Designed to make SORP compliance easier, faster and more accurate

Aedon.Accounting for Charity SORP

The Charity Statement of Recommended Practice (SORP) provides the framework that UK charities must follow when preparing their annual accounts. It ensures financial statements are transparent, consistent and comparable across the sector.

Aedon.Accounting captures and structures your financial data in a way that naturally aligns with Charity SORP, giving you:

Charity SORP: The Challenges vs. The Solution

A look at where charities struggle – and how Aedon.Accounting resolves each issue.

SORP compliance can quickly become complex, especially when data is spread across spreadsheets, fundraising tools and legacy finance systems.

This comparison shows how Aedon.Accounting simplifies the key problem areas and supports every SORP reporting format, all within Salesforce.

Why Charities struggle with SORP Compliance?

Charity finance teams often face challenges such as:

Aedon.Accounting resolves these issues by bringing finance and operational data together in Salesforce.

How Aedon.Accounting supports Charity SORP account formats

Whether your charity prepares SORP (FRS 102) accounts, Receipt & Payment accounts, or Accrual-based financial statements, Aedon.Accounting provides the structure and reporting tools to handle all required disclosures, categories and notes.

This includes:

SORP requirements aren’t difficult – but the systems charities use often are. The above comparison highlights the typical problem areas and demonstrates how Aedon.Accounting supports compliant reporting formats with less effort, fewer errors and better visibility.

Isn’t it time you considered A NEW WAY OF WORKING.

Useful Resources

The Charity SORP – Your Questions Answered

Navigating the complexities of the Charity SORP can be challenging, but we’re here to help.

Below, we’ve answered some of the most common questions charity leaders and finance professionals ask about SORP compliance and reporting.

“Aedon is a reliable and powerful accounting solution for any business, thanks to its seamless integration with Salesforce, user-friendly interface, robust reporting features, and top-notch security measures.”

Daniel Ruthenberg, Account Director at Manras Technologies

Why Charities Choose Aedon.Accounting

Charities often battle with fragmented data, inconsistent fund tracking and time-consuming SORP reporting. Aedon.Accounting removes these barriers by bringing finance, fundraising and operations together in one structured, Salesforce-native platform.

What others are saying

Customer reviews

Aedon.Accounting combines CRM and finance to drive down costs and increase revenues PLUS all the customisation that Salesforce enables. Learn more on our Salesforce AppExchange page.

These are all genuine customer experiences shared by users of Aedon.Accounting on our Salesforce AppExchange page. Click below to learn more.

Discover How SORP Becomes Simpler

See Aedon.Charities in Action

After the demo, you’ll have a clear understanding of how Aedon.Charities handles fund accounting, SORP reporting, disclosures and real-time dashboards inside Salesforce. You’ll see exactly how the platform reduces manual work, eliminates spreadsheets, improves audit readiness, and gives trustees and leadership the clarity they need – all while simplifying year-end and strengthening financial governance across your charity.