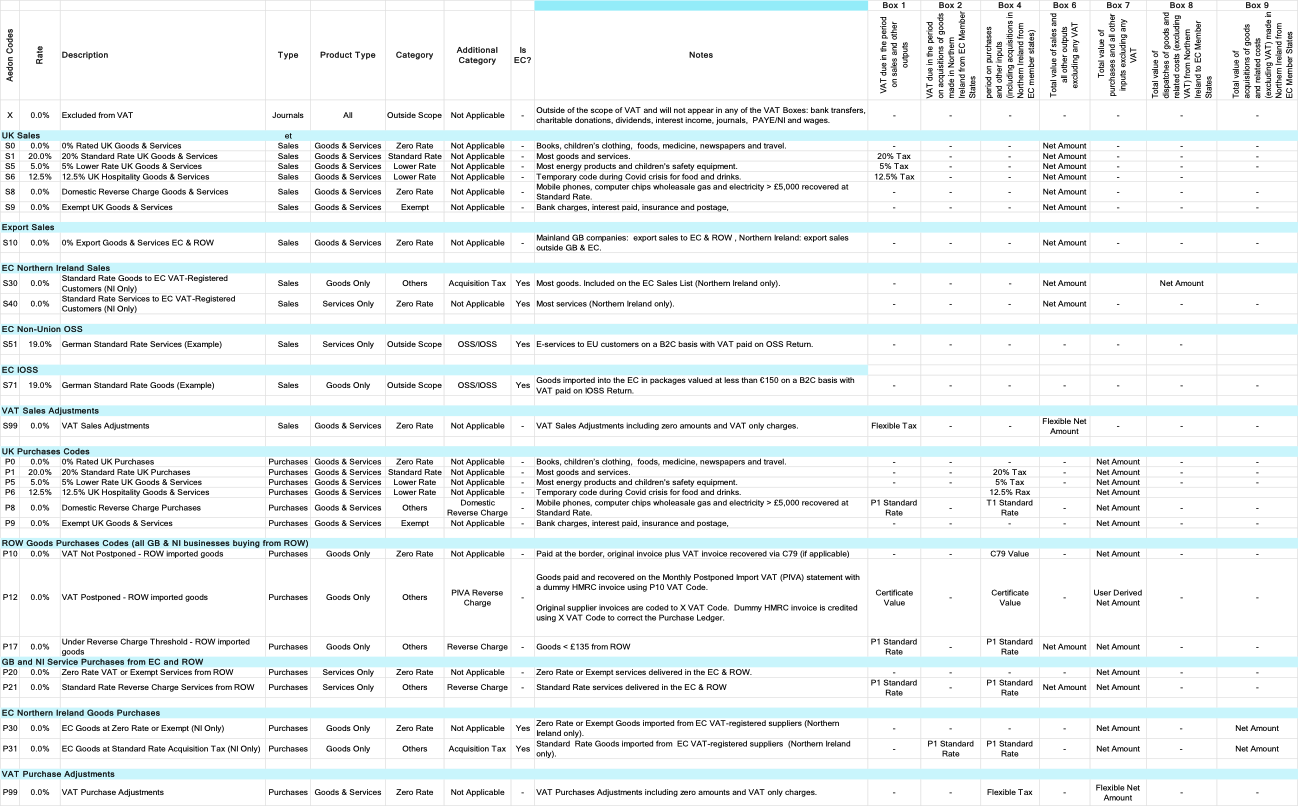

UK VAT Codes (Tax Codes)

The VAT Code structure has been designed to manage all types of Value Added Tax transactions.

- Sales VAT Codes have an “S” prefix.

- Purchases VAT Codes have a “P” prefix.

- “X” VAT Code has a zero rate and is excluded from VAT.

Creating New Tax Codes

It will be rare that you need to add or change the Tax Codes provided with Aedon. We recommend consulting your financial advisor to help decide which VAT Codes are required for your business.

Inactive Tax Codes

We recommend that you make inactive VAT Codes that are not required, to reduce the risk of data entry errors. This will remove them from the list of available options.

(This spreadsheet is attached to this article, if you’d like to view it easier or keep it for your records.)

VAT Code Fields

The VAT Code Fields determine how and where they appear in the VAT Reports. Generally, you will not need to change these’d

| Field | Explanation |

| VAT Code | VAT Code is a shorthand descriptor of the code |

| Active | Active Codes only can be used in Transactions. Inactive Codes are not displayed in Transactions. They can be deleted if you are certain they are not required |

| Description | Description appears in Transactions and can be adjusted according to local terminology. |

| Type | Type determines where the VAT Code is available:

|

| Product Type | Different VAT rules may apply to Goods and Services, so the Product Types helps determine which type of Product it should be applied against. |

| Category | The Category defines the type of VAT Rate being used. There can only be one Standard Rate for Sales and Purchases. |

| Additional Category | The Additional Category is used to determine if an additional VAT value should be calculated |

| Is EC | The EC definition is now only required for Goods and Services supplied from Northern Ireland. |

| Examples | The Examples fields helps with what sorts of Goods or Services should be classified into a particular code. Add your own specific examples for additional clarity. |